when will capital gains tax increase be effective

Note that short-term capital gains taxes are even higher. Currently the top rate on those.

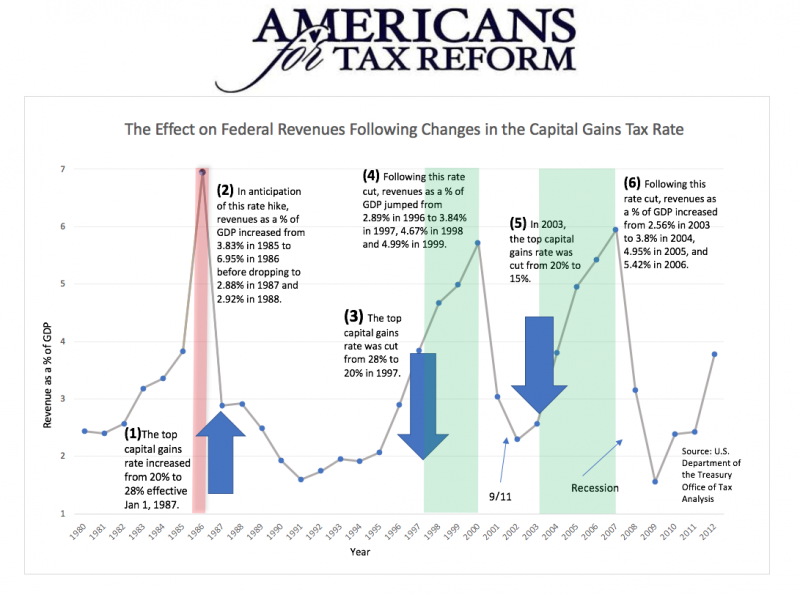

Cutting The Capital Gains Tax Increases Investment And Federal Revenue Americans For Tax Reform

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

. This resulted in a 60. This resulted in a 60. At the state level income taxes on capital gains vary from 0 percent to 133 percent.

However the real gain after adjusting for the doubling of the. While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25. Hed like to raise the top rate on income taxes to 396 from 37.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment. Here are the details. Personal Income Tax I.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. If that change occurs effective in 2022 one way to protect yourself is by accelerating income from 2022 into 2021. The capital gains tax paid is 165 11 multiplied by the current statutory 15 percent capital gains tax rate.

MAXIMUM TAX RATE ON CAPITAL GAINS. With average state taxes and a 38 federal surtax. When a business is sold most of the sale amount is allocated to goodwill and taxed at capital gains rates often pushing the owners remaining income into.

Capital gains on the. Dems eye pre-emptive capital gains effective date. If the top federal capital gains rate rises to 434 percent this would raise the combined tax rate on long-term capital gains to 484 percent.

The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of congress on april 28. Some tax policy experts have similarly suggested that the capital gains rate could end up in the 25 to 30 range rather than nearly doubling to 396 as proposed by President.

Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. Long-Term Capital Gains Taxes.

Further Biden is proposing a hike to the long-term capital gains rate to 396. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. Currently the capital gains rate is 20 for.

This may be why the white house is seeking an april 2021. Capital Gains Tax Increase.

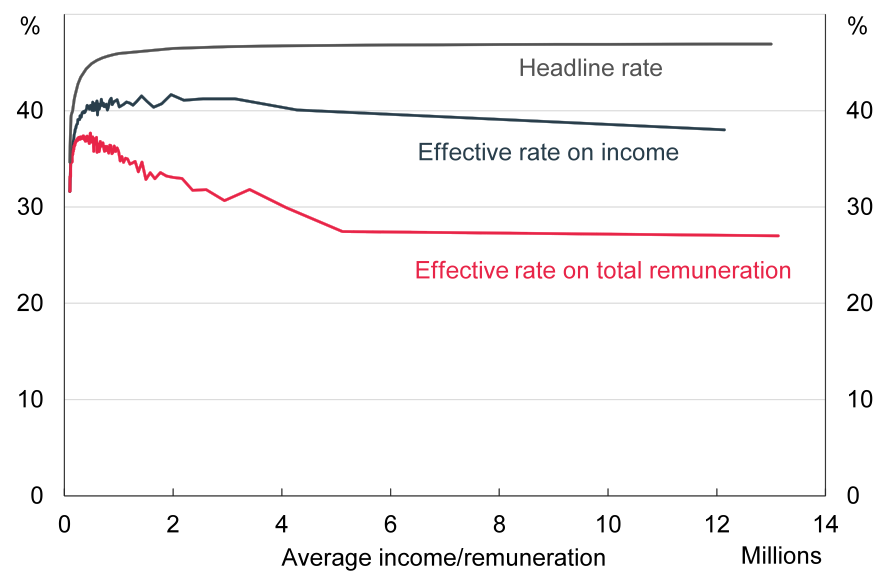

Effective Income Tax Rates Have Fallen For The Top One Percent Since World War Ii Tax Policy Center

How One Can Face An Infinite Effective Tax Rate On Capital Gains Tax Foundation

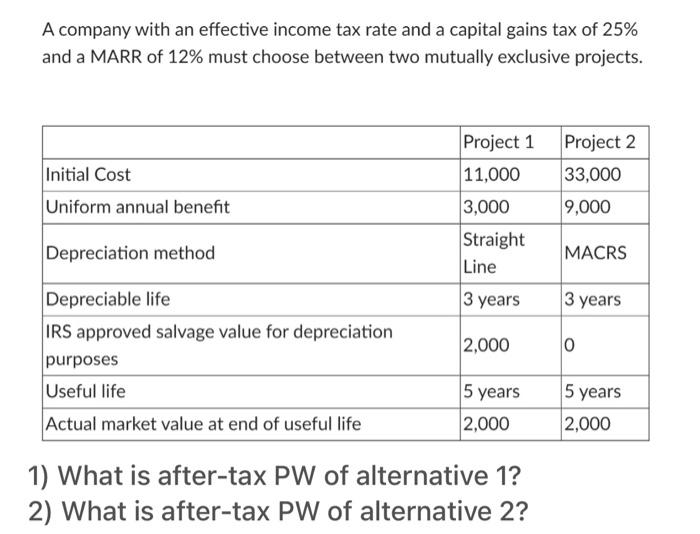

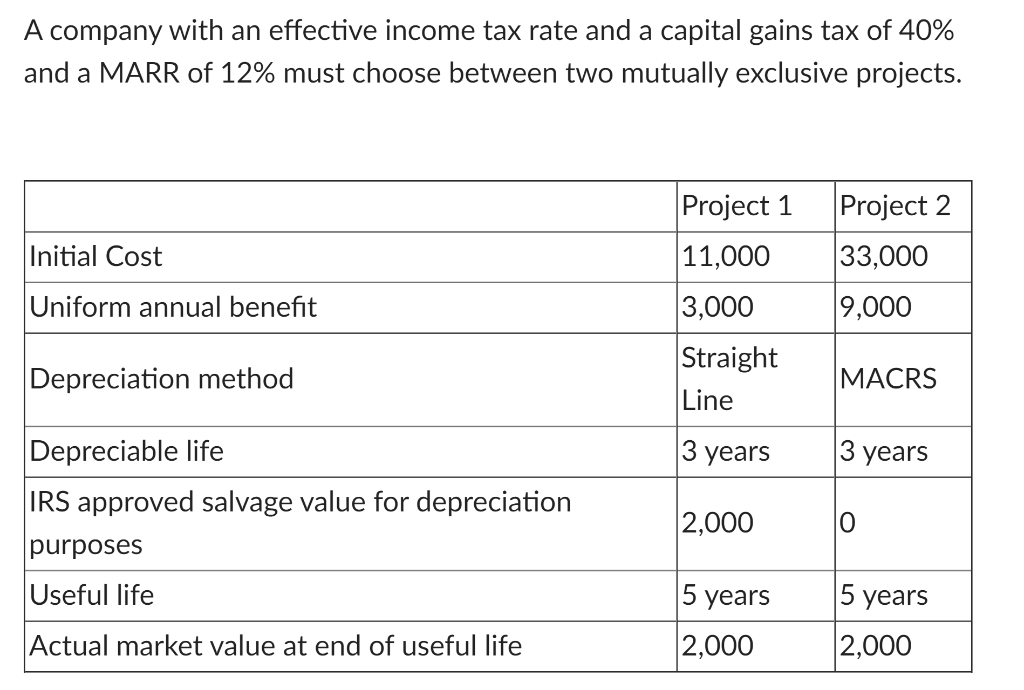

Solved A Company With An Effective Income Tax Rate And A Chegg Com

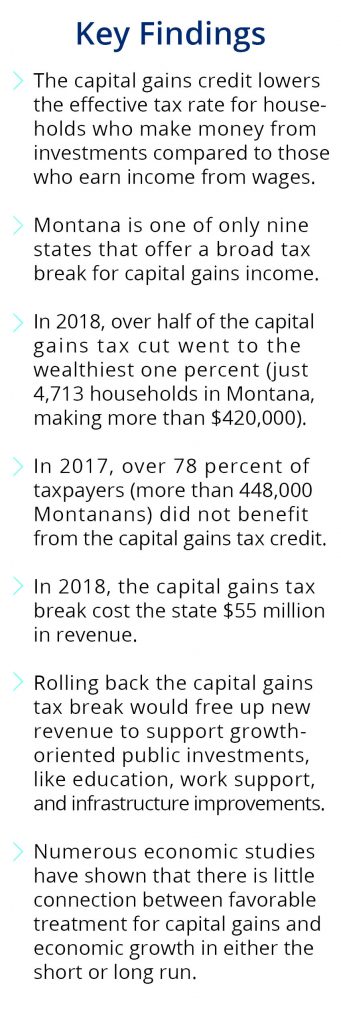

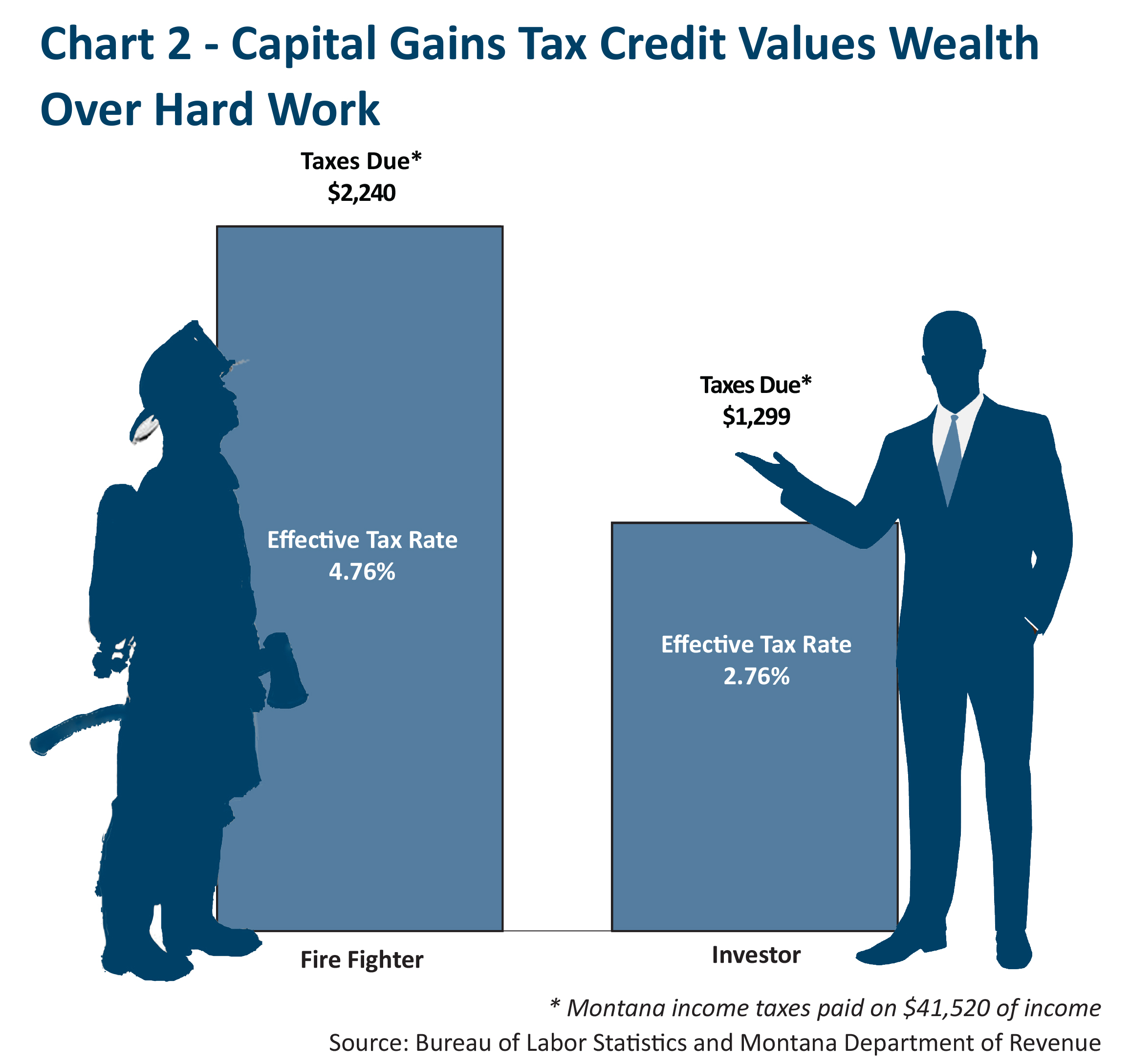

Capital Gains Tax Credit Valuing Wealth Over Work In Montana Montana Budget Policy Center

The Capital Gains Tax And Inflation Econofact

Solved 1 What Is After Tax Pw Of Alternative 1 2 What Is Chegg Com

Will Capital Gains Tax Rates Increase In 2021 Implications For Business Owners Bdo

Amid Inequality Debate In Japan Capital Gains Tax Hike May Have Unintended Effect The Japan Times

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

The Montana We Could Be Tax Cuts Aimed At The Rich Take A Toll Montana Budget Policy Center

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Solved A Company With An Effective Income Tax Rate And A Chegg Com

Time To Take Action For More Tax Fairness Nz Council Of Christian Social Services

Biden Capital Gains Tax Increase Proposed How To Save On Taxes

Are Inflation Taxes Siphoning Your Return Bernstein

Net Capital Gains Tax Would Approach A Whopping 60 Under Biden S Proposal Mish Talk Global Economic Trend Analysis